Corporate governance report 2012

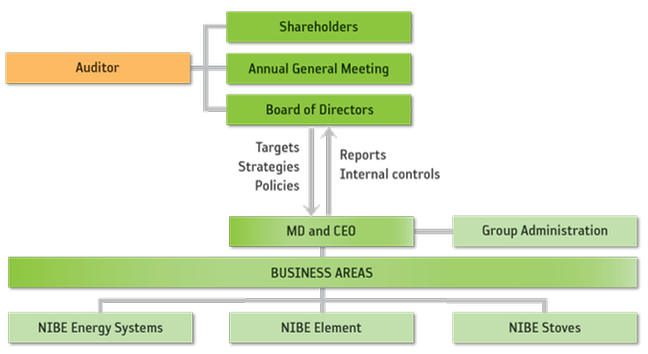

Corporate governance in NIBE Industrier AB (NIBE) is performed by the Annual General Meeting, the Board of Directors and the Managing Director/CEO in accordance with the Swedish Companies Act (Swedish Code of Statutes 2005:551), the company’s Articles of Association, the Swedish Annual Accounts Act (1995:1554), the listing agreement with the NASDAQ OMX Stock Exchange in Stockholm, and the Swedish Code of Corporate Governance (the Code).

It is good practice for Swedish companies whose shares are traded on regulated markets to comply with the Code. NIBE complies with the Code, and this Corporate Governance Report has been drawn up in accordance with the Code. In addition, and likewise in accordance with the Code, NIBE also provides information via the company’s website.

Ownership

NIBE has its registered offices in Markaryd, Sweden, and the company’s shares have been listed on the NASDAQ OMX Stockholm Exchange since 1997, with a secondary listing on the SIX Swiss Exchange since August 2011. On 31 December 2012 NIBE had 16,884 registered shareholders, excluding previous owners of the Schulthess Group AG who have become shareholders in NIBE. As the Swiss authorities do not report any details relating to individual shareholders in Switzerland to NIBE, it is not possible to determine the total number of shareholders. The ten largest shareholders comprise the constellation of ‘current and former board members and senior executives’ with a total of 24% of the capital and 48% of voting rights, followed by Melker Schörling who holds 11% of the capital and 20% of the voting rights, and eight institutional investors with a total of 21% of capital and 10% of voting rights, one of whom represents the previous owners of the Schulthess Group AG. Together these ten constellations of investors hold a total of 56% of the capital in the company and 78% of the votes.

Annual General Meeting

The Annual General Meeting (AGM) is NIBE’s highest decision-making body. The AGM elects the company’s Board of Directors and auditors, adopts the accounts, makes decisions on dividends and other appropriations of profits/losses, and discharges the Board of Directors and the MD/CEO from liability.

The most recent AGM, held on 10 May 2012 in Markaryd, was attended by 340 shareholders. Those present represented 48% of the shares and 74% of the total number of votes in the company. The AGM was attended by the Board of Directors, the MD/CEO and the company’s auditors. The minutes of the AGM and the company’s articles of association are available on the company’s homepage.

There are no limitations in the articles of association as to the number of votes a shareholder may hold at a general meeting of the company, the appointment or dismissal of directors of the company, or changes to the company’s articles of association.

The 2012 AGM gave the Board of Directors a mandate to issue new class B shares, on one or more occasions and without regard to the shareholders’ preferential rights, to be used as payment for the company’s acquisition of other companies or businesses. This mandate is valid until the 2013 AGM and is restricted to a maximum of 10% of the number of class B shares issued at the time of the AGM.

The Board of Directors (left to right): Anders Pålsson, Hans Linnarson, Georg Brunstam, Gerteric Lindquist, Arvid Gierow and Eva-Lotta Kraft.

Board procedures

The NIBE Board of Directors consists of six members, elected by the AGM. Directors of the company and the Chairman of the Board are elected annually by the AGM to serve for the period until the next AGM. Company employees participate in board meetings as required to submit reports or to contribute expert knowledge in individual matters.

The current Board of Directors comprises Arvid Gierow (Chair), Georg Brunstam, Eva-Lotta Kraft, Hans Linnarson, Anders Pålsson and Gerteric Lindquist (CEO of the NIBE Group). With the exception of the CEO, none of the directors of the company is employed by the company or has any operational responsibilities in the company.

It is the opinion of the Board of Directors that all directors with the exception of the CEO are independent in relation to the company. Please see pages 88-89 for a brief presentation of the directors of the company.

The work of the Board is governed by formal rules of procedure adopted annually to regulate the allocation of work, the decision-making processes within the company, authority to sign for the company, meetings of the Board and the duties of the Chairman of the Board. The Board has also adopted instructions concerning the division of work between the Board and the MD/CEO.

The Board of Directors oversees the work of the MD/CEO and is responsible for ensuring that the organisation, management and administrative guidelines for the company’s funds are suitable for the purpose. The Board is also responsible for developing and following up the company’s strategies through plans and objectives, decisions on acquisitions, major investments, appointments to managerial positions and the continual supervision of operations during the year. In addition, the Board sets the budget and is responsible for the annual accounts.

The Chairman leads the work of the Board and ensures that it is carried out in accordance with the Swedish Companies Act and other relevant legislation. The Chairman follows the progress of operations through consultations with the MD/CEO, and is responsible for ensuring that other members of the Board receive the necessary information to enable them to hold discussions of a high quality and make the best possible decisions. The Chairman is also responsible for evaluating the work of the Board.

The work of the Board of Directors

During 2012 the Board of Directors held 14 meetings, of which seven were traditional round-table meetings, four were telephone conferences and three were per capsulam meetings, where information was shared by circulating the papers among the board members. All meetings were minuted.

Attendance at board meetings was good with full attendance for all the round-table meetings.

The agenda includes a number of standing items, which are considered at every meeting

- Status report. Report of significant events affecting operations that have not been listed in the written report that has been circulated.

- Financial report. Review of the financial information circulated.

- Investments. Decisions regarding investments exceeding SEK 10 million, based on the data circulated.

- Legal processes. Review of new or ongoing legal processes when appropriate.

- Acquisitions. Report on ongoing discussions and decisions concerning the acquisition of companies, as and when appropriate.

- Press releases, etc. When appropriate, a review of proposals for external reports to be published after the meeting.

Every ordinary board meeting focuses on one principal topic of discussion, as outlined below:

- Year-end accounts. The meeting in February considers the annual accounts of the preceding year. The company auditor presents his comments to the entire Board of Directors on this occasion.

- Inaugural meeting. Following the AGM, the Board of Directors holds its inaugural meeting, at which the Board discusses the rules of procedure and determines who has authority to sign for the company.

- Strategy. In June, the Board holds strategic discussions over two working days.

- Audit review. In November, the company’s auditor gives his view on the interim figures for the period January to September.

- Budget. At the end of the year, the Board discusses the Group’s budget for the coming year.

In addition, the Board of Directors receives a written report every month on the company’s financial key figures and position. The MD/CEO is also in continual contact with the Chairman of the Board.

The work of the Board of Directors is evaluated once a year.

External Auditors

NIBE’s auditors have been elected at the AGM to serve for a period of one year.

Mazars SET Revisionsbyrå AB was re-elected for a period of one year at the AGM in 2012 with Bengt Ekenberg elected as the senior auditor.

The senior auditor has continual access to the approved minutes of company board meetings and the monthly reports that the Board receives.

The company’s senior auditor reports his observations from the audit and his assessment of the company’s internal controls to the Board as a whole.

Over and above normal auditing duties, Mazars SET Revisionsbyrå assists in particular with due diligence reviews in conjunction with corporate acquisitions and with accounting consultations. Information on the remuneration of auditors is given in Note 5 to the annual accounts.

Group management

The CEO, who is also appointed by the Board of Directors as Managing Director of the parent company, exercises day-to-day control of the Group, and the three directors of the Group’s business areas report to him.

The CEO leads operations in accordance with the instructions adopted by the Board in respect of the division of work between the Board and the MD/CEO. The work of the MD/CEO and of senior management is evaluated annually.

Financing, currency management, corporate acquisitions, new establishments, financial control, financial information, human resources policy and other overall policy matters are coordinated at Group level.

Governance of business areas

NIBE consists of three business areas. Each business area has its own operational management with profit responsibility. Each business area has a Business Area Board chaired by the Group’s CEO. These Business Area Boards also include external members with expertise within the respective areas. Each Business Area Board, in addition to responsibility for day-to-day operations, is also responsible to the NIBE Board of Directors for the strategic development of its respective business area. Each Business Area Board meets once a quarter.

Decision-making process

The NIBE Board deals with all matters of significance. Issues such as the composition of the Board and directors’ fees are dealt with once a year prior to the AGM, when the Chairman of the Board contacts major shareholders personally.

The company’s auditor makes his report to the Board as a whole.

Remuneration to the Managing Director is a matter decided by the Board, but the preparatory work for this decision is undertaken by the Chairman of the Board after discussions with the Managing Director. Remuneration to other senior executives is determined by the Managing Director in consultation with the Chairman. These decisions are reported to the Board.

The company does not have a Nomination Committee (item 2.1 in the Code), a Remuneration Committee (item 9.1 in the Code) or an Audit Committee (item 7.3 in the Code). NIBE does not comply with the Code in respect of nominations because of the clear ownership structure with two principal shareholder constellations, which together control 70% of the company’s votes, and which also enjoy mutually cordial relations. The Board of Directors is not too large to carry out the audit and remuneration tasks in a manner consistent with the Swedish Companies Act and the Code.

Remuneration

The 2012 AGM resolved that the fees to the Board of Directors and the fees to the auditors should be paid in accordance with approved accounts. At the same time, policies for the remuneration of the MD/CEO and other key management personnel were detailed and approved. Further information about the principles that apply can be found in Note 6 to the annual accounts.

Fees for the Board of Directors for 2012 amounted to SEK 1,200,000 in accordance with a resolution upheld by the AGM. Of this amount, the Chairman of the Board received SEK 400,000 in accordance with the AGM’s resolution. Fees are not payable to members of the Board of

Directors who are employed in the Group.

Salary and other remuneration paid to the MD/CEO in 2012 amounted to SEK 3,403,000. The MD/CEO also has free use of a car. Salaries paid to four other senior management executives totalled SEK 9,543,000.These senior executives also enjoy free use of company cars. A financial contribution towards removal costs is available to newly recruited senior executives.

Severance pay

No severance pay or other benefits apply to the Chairman of the Board or to the directors, apart from the MD/CEO. The period of notice for the MD/CEO is six months in the event that the company gives notice. In addition to salary during the period of notice, the MD/CEO is entitled to severance pay equal to 12 months’ salary. Other senior executives are entitled to receive their salaries during a period of notice which varies between 6 and 12 months.

In 2012 it was Jacob Macek from NIBE’s Czech subsidiary, DZD, who received the Bengt Hjelm Scholarship. Since Bengt Hjelm retired as Chairman of the Board of NIBE Industrier in 2004, the award has been presented each year to a young person from one of the many NIBE companies worldwide, who has served as a good example of the commitment and faith in the future that the company stands for.

Pensions

The Chairman of the Board and the directors of the company receive no retirement benefits in respect of their work on the Board. Retirement age for the MD/CEO and other senior executives is 65. No special agreements have been reached that entitle senior executives to retire before the official retirement age while still retaining part of their salary in the interim.

The MD/CEO has an individual pension insurance arrangement that corresponds to ITP (supplementary pensions for salaried employees). For 2012, the premium corresponded to 19% of salary up to 30 so-called “income base amounts” (a statistical amount used in Sweden for calculating benefits, etc.). For salary to the MD/CEO paid in excess of this, a premium payment of 30% was made that corresponds to the defined-contribution ITP plan, section 1. Other senior executives in the Group have retirement benefits that correspond to the ITP plan for that portion of their salary up to 30 income base amounts. For salary in excess of this, a premium of 30% is made in accordance with the defined-contribution ITP plan, section 1. An exception is made in the case of the director of one of the business areas, who, in his capacity as Managing Director, has an individual pension arrangement with premiums that correspond to those of other senior executives.

Incentive programme

An incentive programme applies to certain key members of staff/senior executives, according to which they are paid a variable bonus (equivalent to a maximum of three months’ salary) if set targets are met. The possibility also exists to receive an additional month’s salary on condition that this additional payment plus another monthly salary paid as a variable bonus or part of a variable bonus is used to purchase NIBE shares. A further condition for entitlement to receive this additional month’s remuneration is that the shares thus purchased are retained for at least three years. Under normal circumstances shares acquired in this way shall be purchased on one occasion each year in February/March and the purchase shall be subject to the relevant insider trading regulations. No incentive programme is offered to the MD/CEO. Certain key individuals in the foreign companies acquired during the year have incentive programmes that, in certain respects, deviate from the principles for remuneration that are otherwise applied in the NIBE Group. Further information about the principles that apply for senior executives can be found in Note 6 to the annual accounts.

Communication with the stock market

The ambition is to maintain a high standard of financial information issued by the Group. Such information must be accurate and transparent in order to create long-term confidence in the company.

Earnings and a summary of the Group’s financial position are presented quarterly and, like the annual report, are issued in printed form to all shareholders who so wish. All takeovers and other information that may have an effect on the company’s share price are announced via press releases. Full financial information relating to NIBE Industrier is available via the website www.nibe.com. Press releases and reports are posted there at the same time as they are made public.

During the course of the year there have been a number of meetings with Swedish and foreign financial analysts, the media and Aktiespararna, the Swedish Shareholders’ Association.

Internal controls of financial reporting in 2012

According to the Swedish Companies Act and the Code, the Board of Directors is responsible for internal controls. This report on internal controls and risk management with regard to financial reporting complies with the requirements in Chapter 6, section 6 of the Annual Accounts Act.

Internal controls were an important component of corporate governance even before the new code was introduced.

NIBE is characterised by simplicity in its legal and operational structure, transparency in its organisation, clear divisions of responsibility, and an efficient management and control system.

NIBE complies not only with external laws and regulations in respect of financial reporting, but also with internal instructions and policies set out in the Group’s Finance Handbook. These are applied by all companies in the Group, along with systems aimed at ensuring effective internal controls in financial reporting.

Consolidated financial reports containing comprehensive analyses and comments are drawn up each quarter for the Group and its business areas. Results are also monitored every month.

There are finance functions and controllers with responsibility for accounting, reporting and the analysis of financial trends at Group level, business area level and major unit level.

In addition to the statutory audits of the annual report and statutory audits of the parent and all subsidiaries, the auditors carry out an annual review of how the companies are organised, of existing routines and of compliance with the instructions issued, based on guidelines drawn up by corporate management and approved by the Board of Directors. A summary of internal control procedures is presented each year as part of the board meeting that deals with the year-end accounts.

The Board also has the option of requesting a special audit of a selected business or operations during the year if this is deemed necessary.

It is our opinion that this review increases insight and awareness, provides explicit instructions and proposes a clear organisation in respect of internal controls. It is therefore the opinion of the Board that, because of the implementation of this review, there is no need for any separate internal control (item 7.4 in the Code).